Introduction to MACD

Mastering MACD indicator is essential for trading. Moving average convergence/divergence (MACD) is a technical indicator to help investors identify price trends and measure trend momentum, which helps to determine entry points for buying or selling.

To track a security’s momentum, the moving average convergence/divergence (MACD) indicator is utilized. This is the correlation between two of the exponential moving averages of an asset price.

In 1970 Gerald Appel’s MACD indicator was developed, and it is one of the best technical tools. The same is freely available on almost all trading platforms.

The aim of this content is to master MACD along with Top 7 Powerful Tips to Use the Moving Average Convergence Divergence Indicator for Trading Success”

The best way to know about technical analysis

The best way to learn technical analysis is to understand the core principles and then apply that knowledge via back testing or paper trading. Thanks to the technology available today, many brokers and websites offer electronic platforms that offer simulated trading that resembles live markets.

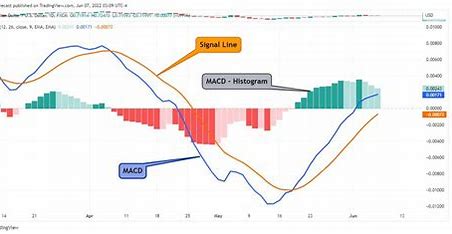

The Components of MACD

MACD consists of three parts:

MACD line

Difference between short-term versus long-term EMA. A simple formula used to calculate the MACD line is: 12-period EMA and 26-period EMA

Signal line

This is the 9-period EMA of the MACD line. It is the signal line that gives the decision to buy or sell an asset.

Histogram

The histogram displays the magnitude and range of motion, as well as the difference between the MACD line and signal line.

Interpreting MACD Charts

Interpreting Moving Average Convergence/Divergence (MACD) Charts: Traders can gain deeper insights into the overall trend and momentum of the market through MACD charts by looking at them in several ways. This helped them master MACD during their trading career.

MACD line

This is used to find out the momentum of an asset when the MACD line is above or below zero.

Positive MACD

This number is above zero and therefore indicates that there is bull market momentum.

Zero level

A negative value of MACD means bearish momentum

MACD line crossovers

When the MACD line crosses above the signal line, it can be considered a buy signal. A sell signal is the MACD line crossing beneath the signal line.

MACD histogram

This shows the variation between the MACD and signal line, represented by the red-green MACD histogram. A positive histogram shows bullish momentum, and a negative histogram represents bearish momentum.

Signal line crossover

The MACD line is a moving average (MA) of the MACD line, depicted as a signal line.

If the price is rising but momentum is weakening, it could indicate a potential move to the downside.

The shorter EMA crosses under the longer EMA, it causes a bearish crossover.

Divergence between price and momentum

When the price goes higher and the momentum is weakening, this can represent that a downside move is likely.

If the price is rising but the momentum is decreasing, it may suggest that a negative movement is forthcoming. MACD can be a versatile technical tool, but it can also be subjective and prone to error.

Mastering MACD rules to choosing timeframes

The best method to find the primary trend of an asset is using a higher time frame on charts. The intermediate time frame/chart is used to find out the certainty of a trade. Move to a shorter time frame to identify real entry and exit points.

Traditional MACD Strategies

The common traditional strategy of MACD to buy is that when the MACD line crosses above the signal line, this is a sign of bullish momentum. A bearish momentum indicates the formation of the sell signal when the MACD line crosses below the signal line. In order to identify possible reversals, forex traders frequently search for differences between the MACD and the price action.

Basic MACD Crossovers

When the signal and MACD line cross one another, it’s called a crossover. The MACD’s bullish signal is produced when it crosses above its nine-day EMA; if it crosses below its nine-day EMA, it produces a bearish sell signal

Both Convergence and Divergence

Convergence occurs when two exponential moving averages (EMAs) move in the same direction, while divergence occurs when they move in opposite directions, according to moving average convergence/divergence (MACD).

A technical indicator called MACD aids investors in determining price trends, gauging momentum, and determining whether to purchase or sell. The MACD line is calculated by subtracting the 12-period exponential moving average (EMA) from the 26-period exponential moving average (EMA) to generate the signal line, which is a 9-period exponential moving average (EMA).

A technical indicator called moving average convergence/divergence (MACD) may be used to evaluate momentum, spot trends, and produce buy or sell recommendations. The MACD may be used in the following ways to validate trends:

Transitions

An uptrend is indicated when the MACD line crosses above the signal line, while a downtrend is indicated when it crosses below.

Histograms

In the histogram, you can see the distinction between the signal line and the MACD line. Growing momentum is shown by an expanding histogram, whereas decreasing momentum is indicated by a narrower histogram.

Divergence

Divergence is the term used to describe when the price moves against the indication. A possible reversal may be indicated by a bearish divergence in an uptrend or a bullish divergence during a downturn.

Incorporate additional indications

When used in conjunction with MACD, the Relative Strength Index (RSI) helps verify the direction and intensity of trends. For instance, there may be a greater chance of a downward trend if the MACD and RSI both show an overbought situation.

Zero line

The zero line can act as either support or resistance, and a sell signal is initiated when the signal line or the MACD line crosses below it.

Advanced MACD Strategies

MACD Histogram Patterns

A histogram displaying the moving average convergence/divergence (MACD) line and the signal line is referred to as the moving average convergence/divergence (MACD) histogram. It can help traders identify trends and generate trade signals.

Histogram above zero: An uptrend may be emerging.

Histogram below zero: A downtrend may be emerging.

Histogram bars grow longer: The speed of price movement is accelerating.

Histogram bars shrink: The speed of price movement is decelerating.

Histogram crosses zero: The momentum direction may be shifting.

Histogram divergences: The signal line of MACD may be converging and ready for a cross due to histogram divergences.

Histogram peak-trough divergences: two peaks or two troughs in the MACD-Histogram.

Histogram height: The momentum strength is determined by the height of the histogram bars.

Traders should verify MACD signals with other indicators and price action to improve accuracy.

MACD Slope and Momentum

The bulls are getting stronger as the MACD histogram’s slope increases. The bears are becoming stronger when it falls. When the momentum and inertia indicators move in the same direction, the system sends out an entering signal; when they diverge, it sends out an exit signal.

Combining MACD with Other Indicators

Here are some ways to combine the Moving Average Convergence Divergence (MACD) indicator with other indicators to get stronger signals:

Trend indicators

A trend indicator like the moving average (MA) can complement the MACD oscillator. For example, a buy order can be opened when both the histogram and the price chart cross the moving average in an upward direction.

Relative strength index (RSI)

Traders can use the RSI to gauge the strength of a trend and identify reversal points.

Bollinger Bands

The MACD’s momentum can be combined with the Bollinger Bands’ ability to identify price breakouts. A buy signal can occur when the MACD line crosses above the signal line and prices move above the upper band.

Moving averages

The MACD is commonly used by traders in conjunction with longer-term moving averages such as the 50-day or 200-day moving average. A bullish trend is reinforced when the price is above the averages and the MACD signals a buy.

Stochastic

A double-cross strategy can be used with MACD and stochastic. For example, a buy signal can occur when the %K value rises above the %D, provided the values are under 80.

Practical Application

Practical MACD Trading Examples

Let’s look at some actual trades using MACD:

Bitcoin bullish crossover

The crossover takes place when the MACD line crosses above or below the signal line. It was before Bitcoin made new all-time highs.

Zero-cross strategy

For example, a trader may see as the MACD dips further down, so do the histogram bars, signaling it might be reversing and an opportunity to short.

Double-cross strategy

During market bullishness, the MACD line crosses over the signal line, suggesting a potential buy signal. The Stochastic %K line is located in the oversold territory, confirming a buy signal.

The moving average convergence divergence (MACD) is a technical indicator that investors take advantage of to identify when trends may be changing. This is a measure of momentum for a stock, and this metric could help investors identify changes in that momentum.

Adjusting stop-loss and take-profit lines

Position the levels

If its a buy, stop-loss must be less than entry level, and take-profit must be more than entry level. When trading for a short, the stop-loss level must be above the rate of the short order, and take revenue needs to be at a lower investment level.

Assess the risk/reward ratio

A lot of traders aim for a risk/reward ratio of 1:2. As an example, you could set a target of a 2% gain per trade and only risk 1% on each trade.

Make use of one-cancels-other (OCO) orders

An OCO (One Cancels Other) order combines two orders to be triggered at the same time, but if one order gets executed, then the other will automatically get cancelled. This is useful for establishing a stop-loss and taking profit on an open position.

Consider your investing style

You put the stops high or low based on how you are investing. As an example, a trader might set their level to 5%, while a long-term investor may set it to 15% or more.

Tailoring MACD To Varying Market Conditions

The default settings that are commonly used for the MACD indicator are 12, 26, and 9. These are the 12-day EMA (fast line), 26-day EMA (slow line), and 9-day EMA (signal line). Although a lot of traders use standard values (like 14, 28, & 9) for daytrading, some adjust to faster periods (like 8, 17, & 9).

Pitfalls and Challenges

MACD is one of the great and well-known indicators, but traders should not forget that it also has disadvantages. These limitations include: MACD can issue false signals during periods of sideways price action or a ranging market due to the crossovers not accurately reflecting trend direction.

False Signals and Whipsaws

However, the Moving Average Convergence Divergence (MACD) is not exempt from false signals and whipsaws, which can cause traders to lose.

False signals

Bullish crossover may show up in the MACD chart when the stock goes down, and opposite is also true—bearish crossover can be observed while the stock goes its way down—this sometimes results in false signals.

Whipsaws

The MACD can create whipsaw movements, where a stock is moved swiftly in one path before reversing and slowing down in the other. We see this in trending and range-bound markets because within a small movement, the indicator changes direction quickly.

Not as reliable in markets with many major swings

In a low-volatility or choppy market, the MACD may not be as reliable.

A few tips to avoid more potential false signals and whipsaws:

Use other indicators

Confirm MACD signals with additional indicators like the RSI or ATR.

Applying stop-losses and trailing stops

Stop-losses and trailing stops can help minimize your losses and secure your profits. This is known as a stop-loss, or just the point at which you leave your trade (in loss), and a trailing stop is simply your dynamic stop-loss that stays right on the heels of price.

Don’t rely solely on the MACD

The MACD is a lagging indication, so it ought to be confirmed in advance of taking motion.

Psychology of Range Trading

When losses occur, traders cannot help but feel emotions like fear and greed or simply impatience, which can push them to do something rashly and ultimately steer away from their initial plan. Discipline and Emotional Control for Successful MACD Range Trading

Stick to your emotions

So managing and being aware of emotional behaviors like stress hormones is termed emotional discipline.

Managing emotions

This little-known but vital aspect of emotional intelligence, which is to not let your own feelings control you or get out of control, regulate emotions, and respond properly to them, as well as be understanding of the actions and feelings of those around you.

- Stick to your emotions

- So managing and being aware of emotional behaviors like stress hormones is termed emotional discipline.

- Managing emotions

- This little known but vital aspect of emotional intelligence, which is to not let your own feelings control you or get out of control, regulate emotions, and respond properly to them, as well as be understanding of the actions and feelings of those around you.

- Self-awareness

- Keep a close watch on your thoughts, actions, and words, which can strengthen your values.

- Stress management

- A key tool to retain good physical and emotional health, well-being, and connections.

- Practicing mindfulness

- Builds your brain muscle to find discomfort without acting on it.

- Self-management

- Emotional resilience, which means the capacity to handle tough events and remain optimistic

- Understanding emotions

- It forms part of emotional intelligence in the sense it is regarding the ability to know about and use emotions or manage them.

- Conflict resolution

- A key aspect of emotional intelligence is knowing what the real problem is in a dispute and resolving it.

Some other things you can do to manage your emotions include:

- Breathing and relaxing daily

- Regular exercise, healthy eating and good sleep

- Making time for self-care

- Time with family and friends

- Communicating with Yourself and Others

- Striking a proper balance between work and life

Handling Losses and Drawdowns

You are going to take the risk and must utilize the most trustworthy methods accessible to achievable recoup losses. However, it is hard emotionally to deal with. You cannot feel pessimistic, yet at the same time you must not feel too much optimism jumping to overcome big losses unrealistic.

Mastering MACD Long-term Success with Trades

With longer-term moving averages such as the 50-day or 200-day moving average, traders typically use MACD. It further strengthens the bullish trend if the price is above these averages, & MACD gives a buy signal. However, if the price is under the moving average sell signal on MACD, it shows a strong bearish trend.

Conclusion

Creating a Custom MACD Trading Strategy

For example, one common strategy is to go long when the MACD line crosses over the signal, identifying bullish momentum. An alternative strategy is to sell when it crosses down (bearish momentum). Forex traders also use the MACD to identify divergences between it and price action to spot potential reversals.

Path Forward: What You Can do Next

- Some resources to continue your learning path:

- Establish goals: Grab specific and attainable targets to keep you motivated.

- Utilize technology: Online learning resources and apps allow you to learn anywhere, anytime.

- Curiosity: Be curious and open to experiences.

- Library Software: Some library software will give you access to books, articles, and other material either for research or leisurely reading.

- Seek additional academic support : Paper writing services provide customized help with the writing process.

- Apply authentic high-involvement strategies: Use immersive techniques like initiating or activating former knowledge and demonstrating learning methods.

- Make Use of Informal Learning: Informal learning is a family-friendly way to build collaboration, fuel creativity, and help shape a strong learning culture.

- Look into continuing education: Continuing education can improve your prospects for promotion and prepare you to apply for higher-level work.

Disclaimer: Trading involves risk. This content is for educational purposes only and should not be considered as financial advice.