Introduction

The power of volume analysis is that it helps traders understand market movements by examining trading activity. By studying the relationship between price and volume, investors can make more informed decisions about market trends and potential reversals.

What is Volume Analysis?

Volume analysis in the stock market examines the number of shares traded during a specific period. It’s a crucial indicator of market activity and investor sentiment. When a stock shows high trading volume, it suggests strong interest from traders, indicating a possible trend or a significant price movement.

For instance, if a stock price is rising on high volume, it could indicate a strong uptrend, as many investors believe in its growth potential. Conversely, a falling price on high volume might signal a downturn or investors losing confidence. The power of volume analysis lies in the ability to detect low volume as a sign of a lack of interest or market indecision.

By analyzing volume alongside price movements, investors can make more informed decisions. It helps confirm trends, detect possible reversals, and gauge the overall market strength or weakness. Essentially, volume analysis provides a deeper insight into the underlying forces driving stock prices.

Why Volume Analysis is Important in Current Markets

The power Volume analysis measures the total number of assets that are exchanged in a certain time period. The number of active addresses is one of these market vital signs and provides insight into how much trading activity and engagement is actually taking place within a market.

However, the transformation of price volumes will make them one of the fundamental tools to predict the direction of the market.

The main elements of Successful Volume Analysis

Volume-Price Relationship

- This often signals strong upward momentum as rising prices are accompanied by rising volume

- High volume with declining prices indicates continuous downward pressure

- Movement on low volume may indicate temporary noise in the market

Trend Confirmation

- Unique Trading Volume Heavy Volume – Prevalent Trends

- Low volumes on price action could suggest a lack of market conviction

- Market moves frequently follow sudden spikes in volume

Reversal Signals

Here are some common volume patterns that can be used to keep an eye out for possible reversals in the market:

- Volume climax at market peaks

- Exhaustion walks with exceptional volume

- Price-Volume Divergences

- The Practical Side of Volume Analysis

Multi-frame Analysis for Trend Detection

Confirm breakout movements

Step Away From False Sentiments & Market Traps.

Gauge overall market strength

Finding the power of Volume analysis is very much a skill that is learnt through practice and an eye for detail. Well, let’s get into it Because by learning how this trading tool fits into your arsenal of trades you’ll better understand how markets can do what it does, thus you’ll feel less confused when taking trades. Remember, volume leads to price, so it is the richest leading indicator of successful trading.

Common Volume Indicators

1. On-balance volume (OBV)

- Cumulative indicator

- Measures buying and selling pressure

- Shows potential divergences

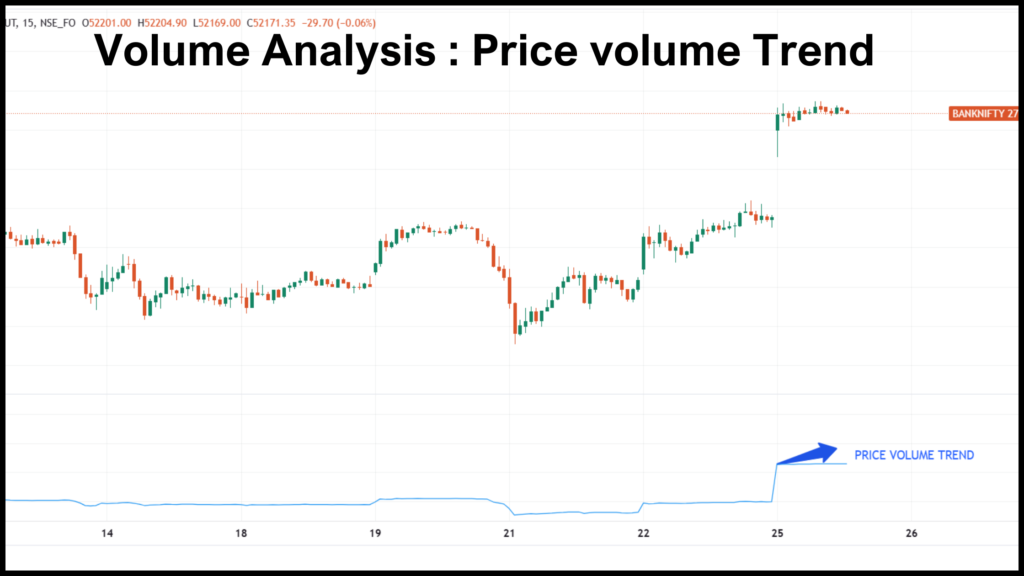

2. Volume Price Trend (VPT)

- Combines price and volume

- Identifies trend strength

- Confirms breakouts

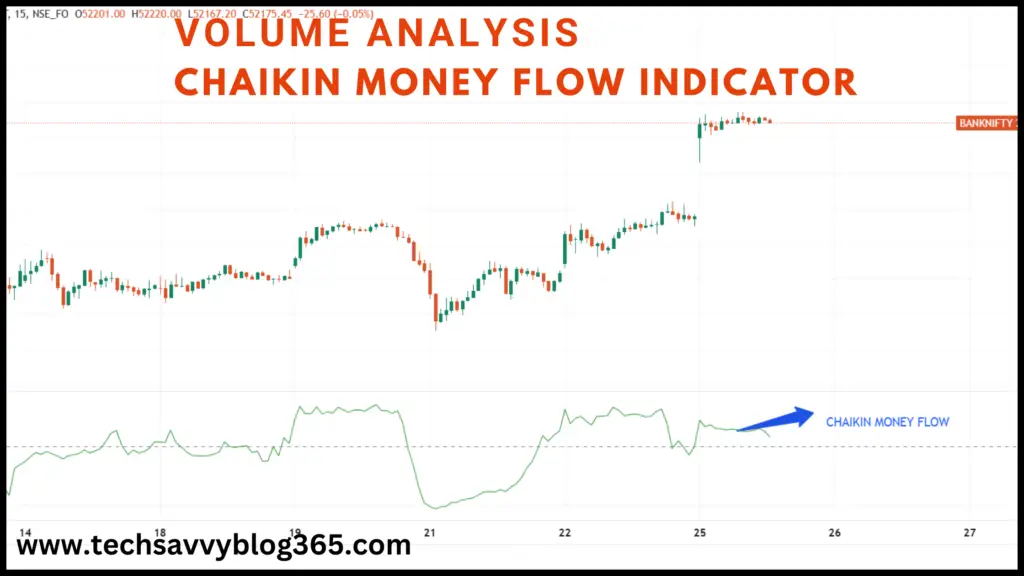

3. Chaikin Money Flow

- Measures buying and selling pressure

- Uses volume to confirm trends

- Shows accumulation/distribution

Volume and Exhaustion in the Market

While conducting the market analysis, “volume” is a blunt instrument which most of the time many traders do not leverage. In simple terms, it is simply the number of shares or contracts that are exchanged hands for a given asset during a specified period. Now, this is a very basic metric, but it gives us an indication of whether the market might be getting tired of going up.

The bane of high-volume

Volume refers to the number of shares traded in a given day. This may then instill confidence, to an extent triggering a large prospective price increase. But these extremes of activity can also be a red flag. This creates an overbought or short market when numerous investors are buying or selling together.

Spotting Exhaustion

The high volume signifies the activity of strong hands, however the price may consolidate or even reverse. This is known as market exhaustion. Picture a marathon where, despite all the training and willpower in the world, runners begin to hit wall after wall as they near their destination.

Likewise in market mechanics, where the volume is significant, but the price continues with either upwards or downward momentum, it shows that buyers/sellers are exhausted. The majority of energy the market had at its disposal has been released, and so we can expect a change in trend or at least stagnation thereof.

Practical Implications

Awareness of exhaustion is important for all those who trade and invest. It may indicate that they need to re-evaluate their approaches. Markets can continue to move in the same direction for long periods of time and if you miss out on this pace, perhaps it is best to take a profit or at least ready yourself for reversal in cases that show signs of exhaustion.

Monitoring volume trends can aid investors in weathering market fluctuations, allowing for more informed decision-making.

Volume Analysis: Tips, Tricks and Traps

These tips will make sure you walk away with new ideas when it comes to volume analysis that can improve your trading strategy:

1. Tip 1: Validate price movements with volume — Always need to confirm trends with volume Increasing volume on price rises is bullish, whereas decreasing volume may indicate a reversal.

2. VOLUME INDICATORS: Utilize a combination of volume indicators such as the Volume Moving Average (VMA) and On-Balance Volume (OBV). They assist in the understanding of what direction the market is taking, and where the next change could be.

3. Pitfall: Volume should NEVER be read in a vacuum. But it should never be treated in isolation; and when used, never to draw erroneous conclusions that may often result from price action and market conditions being what they are.